The Challenge

Springwater Capital was faced with the challenge of managing operations spread out across the western United States. The employees used a multitude of disparate third-party applications to complete their marketing, sales, and fulfillment cycles. Few of these applications were connected to the main office, and those that did connect were missing critical elements Springwater Capital needed to manage their operation.

Springwater Capital required an application that could link all their employee’s work efforts together, and provide fulfillment solutions to every department involved in the operation. They also needed management control over all the Federal compliance rules within their banking operation. All processing data and compliance objectives executed in the company had to be performed and reported in real-time.

The Blue Axis Technologies Solution

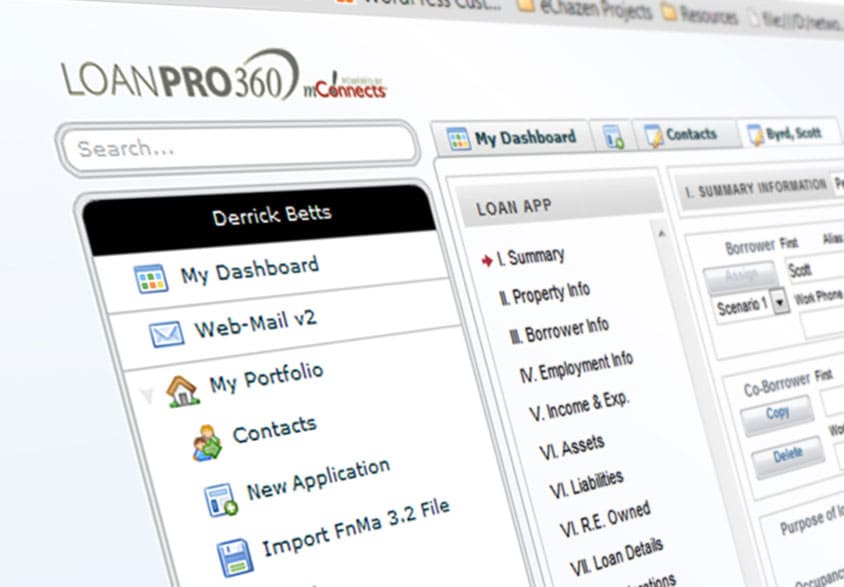

Blue Axis Technologies worked together with Springwater Capital to develop a complete re-build of the existing industry’s Loan Origination and fulfillment processes. The entire system was built to operate in a database-centric and high-performing and scalable cloud solution online.

Springwater’s sales pipeline was coupled into a custom loan application and loan processing system. Tools for PDF creation and manipulation were developed and integrated into the applications, allowing consistent, organized, and automated underwriting submissions. Robust process tracking was designed allowing custom and preset email communications to inform all fulfillment participants when tasks were completed or when human intervention was required.

APIs were created and utilized to gather real-time loan interest rates, pull reports from consumer credit bureaus, perform automated compliance checks, automate property appraisal orders, and integrate with merchant services. A proprietary Mozilla browser plugin was built to help employees further automate tasks within the Springwater fulfillment process.

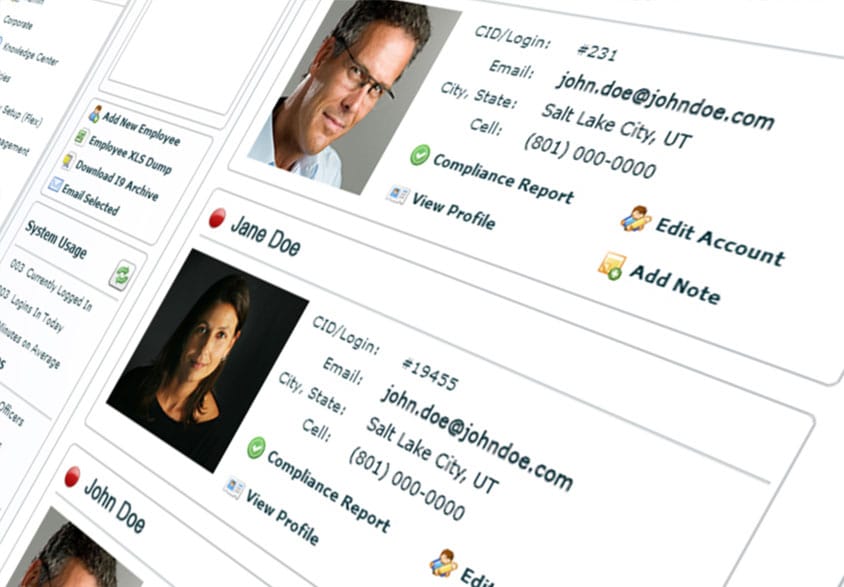

A complete administrative interface was developed allowing executives to manage employees, pull reports, and access every aspect of every file in the system. Federal compliance management was automated into the system using background service algorithms providing real-time compliance verification of Springwater’s files.

In cases where APIs were not available to connect disparate third-party systems, web scraping logic was developed with intuitive algorithms that watched for web page updates/changes and then alerted development to modify the intelligence of the calling utility.

The Result

Springwater Capital, LLC was able to grow their company with an application that gave them the controls they needed to become one of the largest financial services companies in their market. They were able to reduce loan fulfillment process timelines by over 100%, all while knowing that their system would not permit any non-compliant processing activities.

The application locked down files if anything non-compliant emerged. This allowed for reduced compliance oversight compared to their competition and resulted in the highest compliance rating of any financial services operation in the market.

Sales tracking, pipeline management, and loan fulfillment were all managed through secure transmission technologies while the entire application operated inside a network cloud solution. This facilitated simple and easy backups, data archiving, and IT recovery. Springwater Capital eliminated any and all insecure handling of non-public, personal information by implementing existing best-practices and generating proprietary solutions to keep all customer data secure.